| 華師話你知 – Block Extension Scheme for Lodgement of 2023/24 Tax Returns [Extended Due Date for ‘M’ Code Returns] |

華師話你知 – Block Extension Scheme for Lodgement of 2023/24 Tax Returns [Extended Due Date for ‘M’ Code Returns]

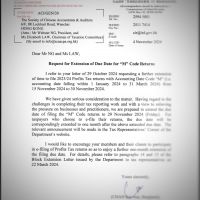

In response to SCAA's letter to the Inland Revenue Department ("IRD") dated 29 October 2024 requesting for further extension up to 30 November 2024 to file the 2023/24 Profits Tax Returns for companies under the M-Code accounting dates, we are happy to report that the Commissioner of Inland Revenue has agreed to extend the due dates of filing to 29 November 2024 (Friday). Please refer to the enclosed letter from the IRD agreeing to the extension.

The IRD has also reminded that the due dates for taxpayers choosing e-filing of their tax returns have therefore extended to 29 December 2024 (one month after the above extended due date).

Members are encouraged to participate in voluntary e-filing of Profits Tax returns so as to enjoy a further one-month extension of filing deadline. However, please be reminded that this type of applications need to be made on separate schedule showing, for each case, the departmental file number, accounting date code and issue date of the return. The applications must be received by the Department at least 7 working days before the returns are otherwise due for submission.

Please refer to https://www.ird.gov.hk/eng/ese/bes.htm and also the attached file for more information.

We would like to thank the Commissioner of Inland Revenue and the Government for their kind understanding.

免責聲明

本郵件內容的準確性、可靠性、安全性及時間性,香港華人會計師公會概不作任何明示或默示的保證,香港華人會計師公會亦不作出任何明示或暗示保證該等內容適合使用。對任何由本郵件所載資料所產生或與之相關的損失或損害,香港華人會計師公會概不承擔任何責任。你有責任自行評估本郵件包含的所有資料,並須加以核實,例如聯絡政府相關部門,以及在根據該等資料行事之前徵詢獨立意見。

|

|

||